A Few Words About Us

We here at HBW Advisory LLC Here specialize in looking at the WHOLE PICTURE for our clients by re-allocating and re-positioning retirement assets for safety, growth, legacy planning, and income planning. We gather complete information to help our clients make informed decisions in an easy to understand manner to assist with their particular situation.

Financial Services

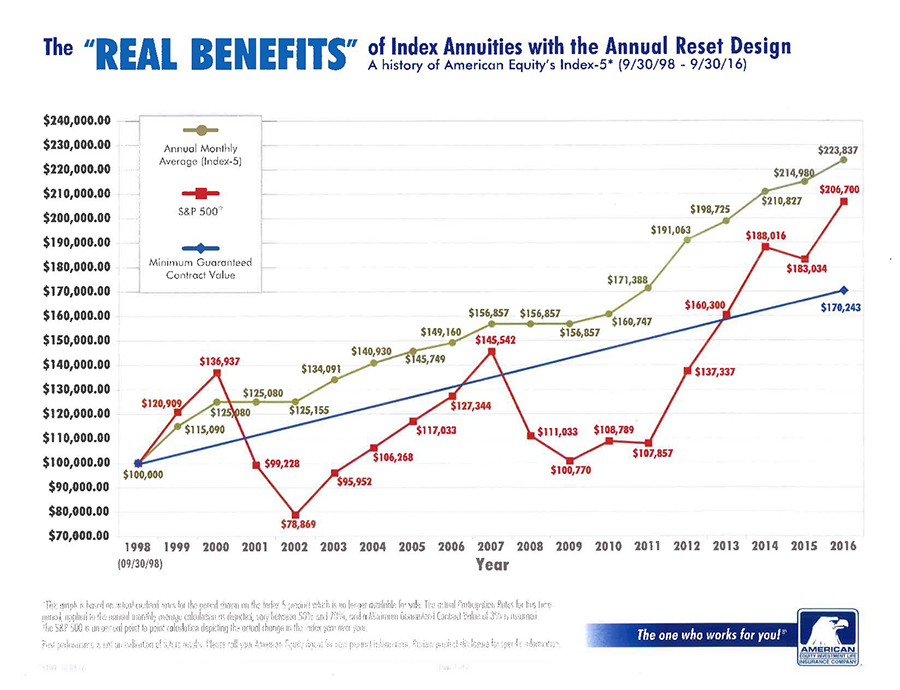

Our primary goal is keeping our clients’ money safe from volatile and risky investments.

Learn MoreInsurance Services

Developing the right portfolio of insurance products is an essential step toward a comprehensive financial program or estate planning.

Learn MoreResources

Learn MoreEducational Videos

Check our very informative educational video page. Here you can watch and learn some valuable information about financial and insurance services

Learn MoreWEEKLY NEWSLETTER

Weekly Market Commentary

Investors endured a difficult week as the conflict between the US, Israel, and Iran continued. Iran’s efforts to target US military bases in the region broaden the conflict across the Middle East. Energy shipments through the Strait of Hormuz have come to a...

IRA Beneficiaries and Contribution Limits: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: Is it wise to designate a grandchild as primary beneficiary for IRA accounts? Answer: You can choose to name whomever you want as your IRA beneficiary. If you want your IRA funds to go to your...

The Retirement Wildcard: How Healthcare Costs Can Impact Your Financial Future

When most people think about retirement planning, they focus on the obvious questions: Will my savings last? How much income will I need? When should I take Social Security? But there’s one major expense that often catches retirees off guard. Healthcare. In fact,...

IRA ARTICLES

IRA Beneficiaries and Contribution Limits: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: Is it wise to designate a grandchild as primary beneficiary for IRA accounts? Answer: You can choose to name whomever you want as your IRA beneficiary. If you want your IRA funds to go to your...

Rolling Over Your Retirement Plan? Here Are 5 Things to Know About Your RMD

By Sarah Brenner, JD Director of Retirement Education These days many Americans are still working long beyond what has traditionally been retirement age. This may be by choice or by necessity. If this is your situation, you may be keeping funds in your employer plan...

Fatal Error: Mistakes That Cannot Be Fixed – Part 1

By Andy Ives, CFP®, AIF® IRA Analyst When a transactional mistake is made with retirement plan or IRA assets, there is oftentimes a mechanism to correct the error. For example, if too much money is contributed to an IRA, a person can leverage the excess contribution...