A Few Words About Us

We here at HBW Advisory LLC Here specialize in looking at the WHOLE PICTURE for our clients by re-allocating and re-positioning retirement assets for safety, growth, legacy planning, and income planning. We gather complete information to help our clients make informed decisions in an easy to understand manner to assist with their particular situation.

Financial Services

Our primary goal is keeping our clients’ money safe from volatile and risky investments.

Learn MoreInsurance Services

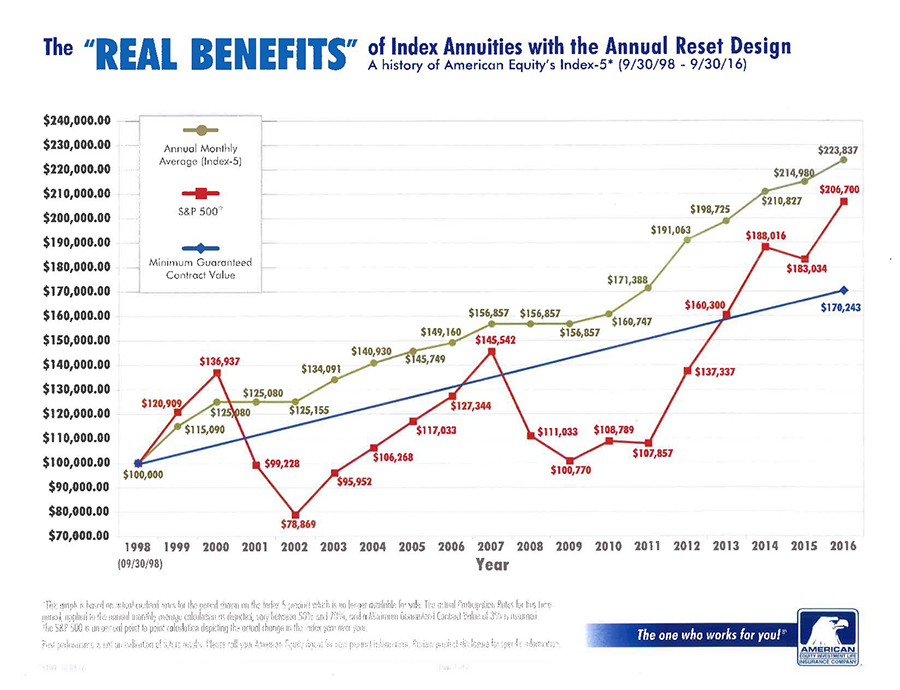

Developing the right portfolio of insurance products is an essential step toward a comprehensive financial program or estate planning.

Learn MoreResources

Learn MoreEducational Videos

Check our very informative educational video page. Here you can watch and learn some valuable information about financial and insurance services

Learn MoreWEEKLY NEWSLETTER

Qualified Charitable Distributions and Roth IRA 5-Year Rules: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: Hello Mailbag Folks, I may have missed something in one of the Ed Slott newsletters, but I thought that if one contributed to a non-profit directly from an IRA account to the non-profit, the amount would not be taxed. I made my...

Understanding Annuities: Turning Retirement Savings Into Reliable Income

Planning for retirement has changed dramatically over the past few decades. In the past, many retirees relied on pensions and Social Security to provide dependable income throughout retirement. Today, pensions have largely disappeared, leaving many retirees...

Fatal Error: Mistakes That Cannot Be Fixed – Part 2

By Andy Ives, CFP®, AIF® IRA Analyst In our Slott Report entry from March 2 (“Fatal Error: Mistakes That Cannot Be Fixed – Part 1,”) we discussed three irreversible mistakes and the negative consequences of each. Despite any repercussions, certain IRA and...

IRA ARTICLES

Qualified Charitable Distributions and Roth IRA 5-Year Rules: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: Hello Mailbag Folks, I may have missed something in one of the Ed Slott newsletters, but I thought that if one contributed to a non-profit directly from an IRA account to the non-profit, the amount would not be taxed. I made my...

Fatal Error: Mistakes That Cannot Be Fixed – Part 2

By Andy Ives, CFP®, AIF® IRA Analyst In our Slott Report entry from March 2 (“Fatal Error: Mistakes That Cannot Be Fixed – Part 1,”) we discussed three irreversible mistakes and the negative consequences of each. Despite any repercussions, certain IRA and...

Act Quickly to Avoid Double Taxation on Excess 401(k) Deferrals

By Ian Berger, JD IRA Analyst If you made excess deferrals to your 401(k) or 403(b) plan(s) in 2025, you need to correct the error while there’s still time. The deadline is April 15, 2026. If you don’t act before then, you’ll be double-taxed on the excess deferrals....